What Is the Process of Buying a Home in Florida Compared to Other States?

What is the process of buying a home in Florida compared to other states?

Buying a home in Florida follows many of the same steps as other states, but there are key differences—such as closing being handled by title companies instead of attorneys, required flood zone disclosures, and unique homeowner association (HOA) rules. Working with experienced local REALTORS® like the Jamison Team ensures you understand Florida-specific details while navigating the process smoothly. Read more below.

How Buying a Home in Florida Differs From Other States

Every state has its own rules, customs, and processes for buying a home. If you’ve purchased property elsewhere in the U.S., you’ll find Florida has some important differences to keep in mind.

1. Closings Are Title-Driven, Not Attorney-Driven

-

In many states, real estate attorneys are required to handle closings.

-

In Florida, closings are typically overseen by a title company or the seller’s attorney. The title company issues title insurance and ensures the closing is legally binding.

-

Buyers can still hire their own attorney, but it’s not mandatory.

2. Escrow and Deposits

-

In Florida, your escrow deposit (earnest money) is usually held by the title company.

-

Escrow deposits are often due within 3 business days of contract acceptance.

-

In some states, deposits can be delivered later in the process or held by attorneys.

3. Flood Zone and Insurance Requirements

-

Florida’s geography means flood insurance is a major factor when buying a home.

-

FEMA flood maps determine whether insurance is required. Even outside high-risk zones, many Tampa buyers opt for supplemental coverage.

-

Insurance premiums can vary widely depending on elevation and location.

4. Property Taxes and Homestead Exemption

-

Florida homeowners benefit from the Homestead Exemption, which can reduce taxable value by up to $50,000 and cap annual increases.

-

In other states, tax benefits may differ significantly.

-

New buyers in Tampa Bay should budget for property taxes averaging 1%–1.2% of assessed value annually.

5. HOAs and CDDs (Community Development Districts)

-

Many Tampa Bay communities, including Bexley, Starkey Ranch, and Connerton, have both HOAs and CDDs.

-

CDD fees cover infrastructure (roads, utilities, amenities), which is uncommon in many states.

-

HOA rules in Florida can be stricter—covering rentals, exterior paint colors, and even holiday décor.

6. Inspection Period and “As-Is” Contracts

-

Florida commonly uses an “As-Is” Residential Contract, which gives buyers the right to inspect and cancel within a set period (often 7–15 days).

-

In some states, sellers must make certain repairs or provide warranties. In Florida, the burden is on the buyer to inspect the home and decide if they want to move forward. If problems arise during the inspection, you can cancel or attempt to negotiate repairs or credits with the seller. However, the seller has no obligation to make repairs or credits when using the As-Is Residential Contract.

7. Title Insurance

-

In Florida, title insurance is required for most transactions. Who pays (buyer or seller) depends on the county.

-

In the Tampa Bay area, it is common for the Seller to pay for the title insurance.

8. No State Income Tax

-

Florida is one of the few states with no personal state income tax, making it attractive for relocation buyers.

-

In states with income tax, this doesn’t affect the purchase process directly but impacts overall affordability.

The Standard Steps to Buy a Home in Florida

While there are unique differences, the general steps align with the home-buying process nationwide:

-

Get Pre-Approved – Work with a local lender who understands Florida insurance and CDD/HOA fees.

-

Hire a REALTOR® – Partner with a local expert like the Jamison Team who knows Tampa Bay neighborhoods and builder reputations.

-

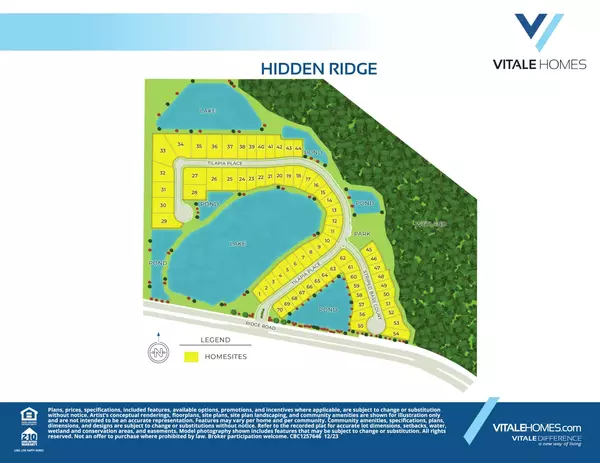

Search for Homes – Consider resale and new construction options in communities like Asturia, Bexley, or Starkey Ranch.

-

Make an Offer – Submit using the Florida “As-Is” or standard FAR/BAR contract.

-

Deposit Escrow – Place earnest money within 3 business days.

-

Inspection Period – Conduct home, pest, wind mitigation, and 4-point inspections.

-

Appraisal & Financing – Your lender confirms value and finalizes your loan.

-

Title Work – Title company confirms clear ownership and issues title insurance.

-

Closing Day – Sign documents and receive keys, often at the title company’s office.

Local Insights for Tampa Bay Buyers

-

Insurance Costs: Tampa homes near the coast or in older neighborhoods like South Tampa may face higher windstorm and flood premiums.

-

New Construction: Builders in Pasco and Hillsborough often offer incentives like closing cost assistance—but only if you use their preferred lender and title company.

-

Relocation Buyers: If you’re moving from states like New York or Illinois, expect faster closing timelines. Florida transactions often close in 30 days or less.

Why Work With the Jamison Team

The Jamison Team is ranked among the top 1.5% of REALTORS® in Tampa Bay, with extensive experience guiding buyers relocating from out of state. We explain the differences, prepare you for Florida-specific costs, and negotiate on your behalf.

Our clients value that we:

-

Break down insurance and HOA/CDD costs up front.

-

Provide detailed market data for neighborhoods like Odessa, Land O’ Lakes, and Wesley Chapel.

-

Connect you with trusted lenders, inspectors, and insurance agents who understand Florida’s market.

Conclusion

Buying a home in Florida compared to other states comes with unique steps—title closings, flood insurance, HOA/CDD rules, and homestead benefits. These differences can impact your costs and responsibilities as a homeowner. The good news? With the right guidance, the process is smooth and manageable.

If you’re ready to buy a home in Tampa Bay, the Jamison Team is here to guide you every step of the way.

Recent Posts

GET MORE INFORMATION